A Blueprint for Modernizing Your Procure to Pay Process

Everything comes at a cost; from a Norton Anti-Virus subscription to paper clips strewn about a person’s desk. All products and services have a monetary value. In the business world, the process of ordering and paying for these products/services is called procure to pay.

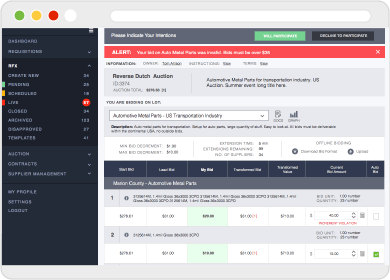

See how we do it

What is Procure to Pay (P2P)?

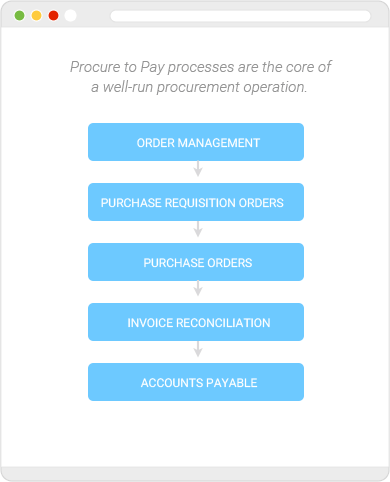

Procure to Pay is the process companies follow to obtain the products and services they need to do business. All companies must run their P2P process efficiently to continuously manage their cash flow, build positive supplier relations and make returns on investments. The P2P process is highly detailed and time-intensive with many opportunities to miss the realization of cost savings. Using automated procurement software can prevent companies from losing money and save them time throughout the P2P steps: Order Management Plans, Requisition Orders, Purchase Orders, Invoice Reconciliation, and Accounts Payable.

The American Productivity & Quality Center’s (APQC) Open Standards Benchmarking in procurement identified that the top-performing businesses experienced cost-effectiveness, process efficiency, faster cycle time, and higher staff productivity whey they used automated procurement software.

Order Management Plans

Businesses must define an order management plan long before executing a P2P process. These plans outline the required products and services routinely needed, with the expected prices detailed for each item. Budgets are then set for each department or category of products/services, with order and delivery timelines forecasted. A system of checks and balances is also specified, listing authorizations at each step of the P2P process. An order management plan should also include a company’s list of preferred and applicable suppliers. Companies initially create a supplier list by submitting inquiries to multiple suppliers; asking for prices, terms of delivery, and quality of materials. Instead of wasting time, money and resources tracking this information using a paper record-keeping system, companies can securely and digitally store files using procurement software.

WITH

SOFTWARE

50%

Reduction

in TIME

The Association of Proposal Management Professionals (APMP) Journal reported that hundreds of companies experience a 50% reduction in time spent on their procurement process when using procurement software.

Purchase Requisitions

Purchase Requisition orders are in-house, formal requests for products or services. Requisitions include a description of products/services, authorization signatures, and a price from an authorized supplier. Procurement departments oversee and closely monitor the requisition orders to prevent the threat of company fraud.

WITH

SOFTWARE

5%

Reduction

in FRAUD

In a global study done by the Association of Certified Fraud Examiners (ACFE), it was estimated that most companies lose 5% of their annual revenue to fraudulent claims on requisition orders. Using automated systems can help avert misrepresentation on order requests because companies can easily and electronically compare present to past requisitions, as well as the ability to match requisition orders to supplier information.

Have Questions? Connect with us today.

Purchase Orders

After a requisition order is approved, a purchase order is crafted. After the purchase order is approved, it is sent to the supplier. The purchase order is a request for services or products - listing quantities, types, agreed to prices, tracking numbers, and delivery requirements. The more details a company includes in their purchase order the more effective it is for both company and supplier. The process of the purchase order becomes automatic through the use of procurement software, resulting in faster supplier lead time.

WITH

SOFTWARE

6

20

The APQC reports that companies using automated services have supplier lead time of six hours, whereas companies without software have supplier lead time of 20 hours.

Invoice Reconciliation

Once orders are received they are checked for quantity, quality, and purchase order. A Goods Receipt acknowledging acceptance of products is then created. At this time suppliers also invoice the company.

ELECTRONIC

DOCUMENT

The invoice is then compared to the purchase order and Goods Receipt, to ensure all charges and delivery of items are as expected. This process is often called the “3-way match” and can be eliminated for a more automatic system when using procurement software. Slimming down to one electronic document helps erase errors and irregularities made in the “3-way match” system.

Accounts Payable

The final step in the procure to pay process flow is to send payment to a supplier and then enter the payment amount into the accounting systems. All details must be recorded so that a company can closely monitor their cash flow. Once the supplier receives payment the procure to pay cycle comes to a close. Through electronic payment processes, companies can deliver payment to their suppliers faster, helping grow their supplier relations and letting them capitalize on early-pay discounts. The monitoring of cash flow becomes easier and automatic for the company as well.

Software Saves Time and Money

To help you decide if modernizing your P2P process with procurement software is worth it, consider how much time and money you have spent on paper-based, manual processes. If you're ready to renovate your P2P process schedule a 30-minute demo of ProcurePort’s cloud-hosted e-procurement solution today.